Parts of Contract: A Clear Guide to Their Essential Elements

Discover the parts of contract and how each clause protects your business. Learn clear drafting tips and practical review checklists.

Tired of nonsense pricing of DocuSign?

Start taking digital signatures with BoloSign and save money.

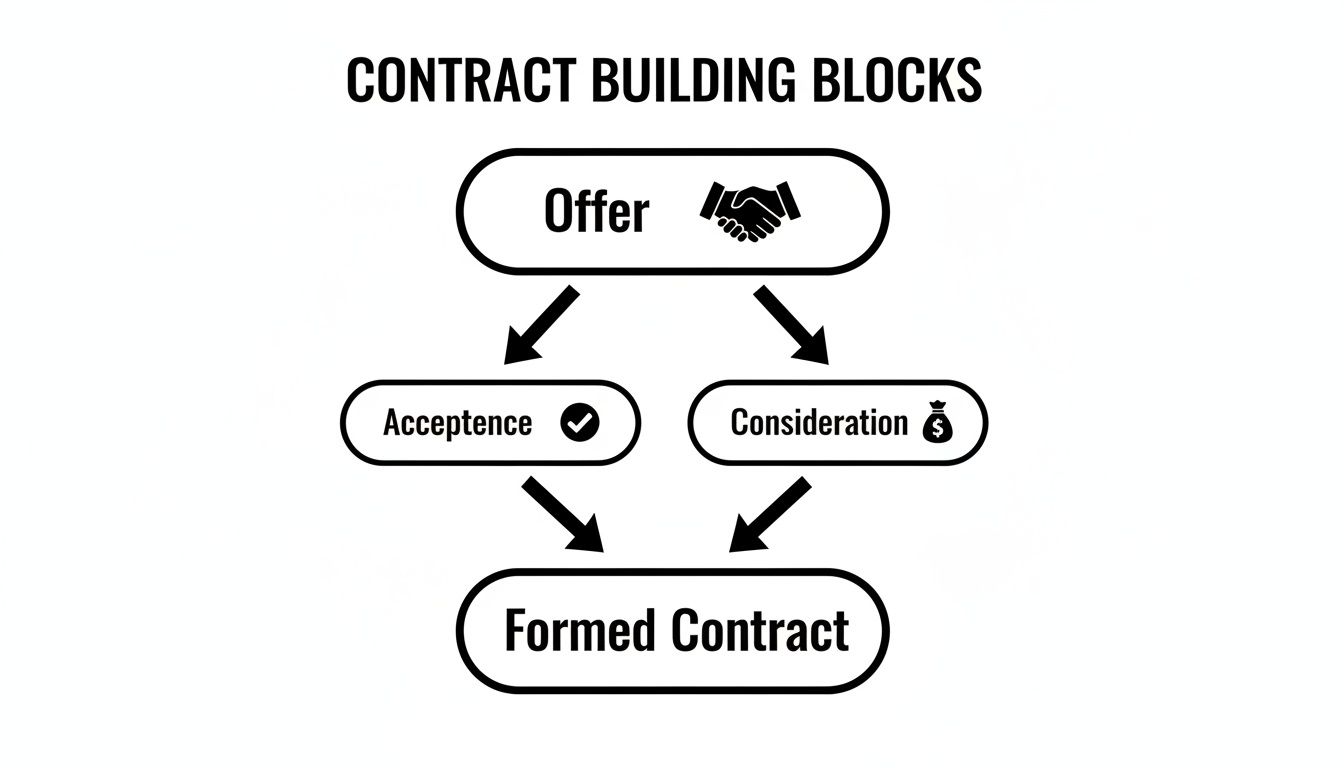

Think of a contract as the blueprint for any business relationship. For that blueprint to be legally sound, it absolutely must have three key parts: the offer, the acceptance, and the consideration. Get these three right, and you have a binding agreement. Get one wrong, and you just have a conversation.

Understanding how these elements work together is the first step to building contracts that actually protect you and your business.

Building Your Agreement From the Ground Up

Every solid agreement is built on the same foundation. Just like a house needs a foundation, frame, and roof to stand, a contract needs specific components to be legally valid. Before you get into the complex details, you have to master the fundamental contractual terms that form the backbone of any deal.

Let's break down these core parts into plain English.

The Three Pillars of a Valid Contract

Imagine you’re a real estate agent sending a purchase offer to a seller. The document details the price, closing date, and conditions. That document is your offer—a clear, direct invitation to enter into a deal.

The seller reviews it, agrees to all terms, and signs it. That’s the acceptance—an unconditional agreement to the exact terms you offered.

Finally, you deliver the buyer's earnest money deposit to the escrow agent. That deposit is the consideration—the value exchanged between both parties. It doesn't always have to be money. In a professional services agreement, it's the service provided in exchange for payment.

Together, the offer, acceptance, and consideration create what lawyers call a "meeting of the minds." This is the magic moment when a simple discussion turns into an enforceable legal commitment, ensuring both sides are crystal clear on what they're giving and what they're getting.

This simple flowchart shows how these pieces connect to form a contract.

As you can see, it’s a sequence. You can't have acceptance without an offer, and the whole thing isn't binding without consideration.

It doesn’t matter what industry you're in—a staffing agency onboarding a new hire, a healthcare provider signing a service agreement, or a logistics company finalizing a shipping deal—these three pillars are universal. If you want to go deeper on the drafting process, our guide on how to write a contract is a great next step.

Once these foundational parts are locked in, you have to execute the agreement. This is where modern tools completely change the game. Instead of the old print-scan-mail routine, a platform like BoloSign lets you create, send, and sign PDFs online instantly. Its secure and compliant eSignature solution ensures your well-built agreement is finalized with the speed and professionalism your business demands.

Defining the Who, What, and Why of Your Contract

Once you've nailed down the core offer, acceptance, and consideration, the next parts of your contract are all about setting the stage. These foundational sections—the preamble, recitals, and definitions—work together to define the "who, what, and why" of the deal. Get them right, and you prevent a world of confusion before it even starts.

Think of it like the opening scene of a movie. The preamble introduces the main characters—the parties bound by the agreement. It clearly states their legal names and addresses, leaving zero ambiguity about who is on the hook. This sounds simple, but it's critical; misidentifying a party can make the entire agreement fall apart.

Setting the Context with Recitals and Definitions

After introducing the parties, the recitals give us the backstory, or the "why." You'll often see these clauses starting with "WHEREAS," and they explain the context and purpose of the deal. For instance, in a logistics contract, the recitals might state that one company needs goods moved and the other has the fleet to do it. While not always legally binding themselves, they offer crucial insight into what everyone intended.

Next up are the definitions. This section is the contract's official dictionary. It locks in the meaning of key terms used throughout the document, so there’s no room for creative interpretation later.

- In a real estate deal, defining "Property" with the specific parcel number and all included fixtures is non-negotiable.

- For a healthcare provider's agreement, defining "Protected Health Information" (PHI) is absolutely essential for HIPAA compliance.

- In a staffing contract, "Consultant Services" must be spelled out clearly to define the exact scope of work.

Nailing these initial sections isn't just a job for the legal department anymore. According to the WorldCC Benchmark Report, nearly 29% of a company's workforce is now involved in some aspect of contract management. That's a huge shift from when it was a siloed legal function, and it highlights why agreements need to be clear enough for everyone from sales to finance to understand.

This is precisely where a platform like BoloSign gives you a strategic edge. You can create standardized, pre-approved templates with these foundational sections already locked in. This ensures every contract your team sends—from an education enrollment form to a logistics service agreement—starts on a compliant and risk-averse footing.

By automating the creation of these critical parts of a contract, you empower your entire organization to move faster without sacrificing accuracy. Whether you need to add a signature to a Google Form for client intake or execute a complex master service agreement, a clear framework is the first step toward a successful outcome.

The Operative Clauses That Drive Your Agreement

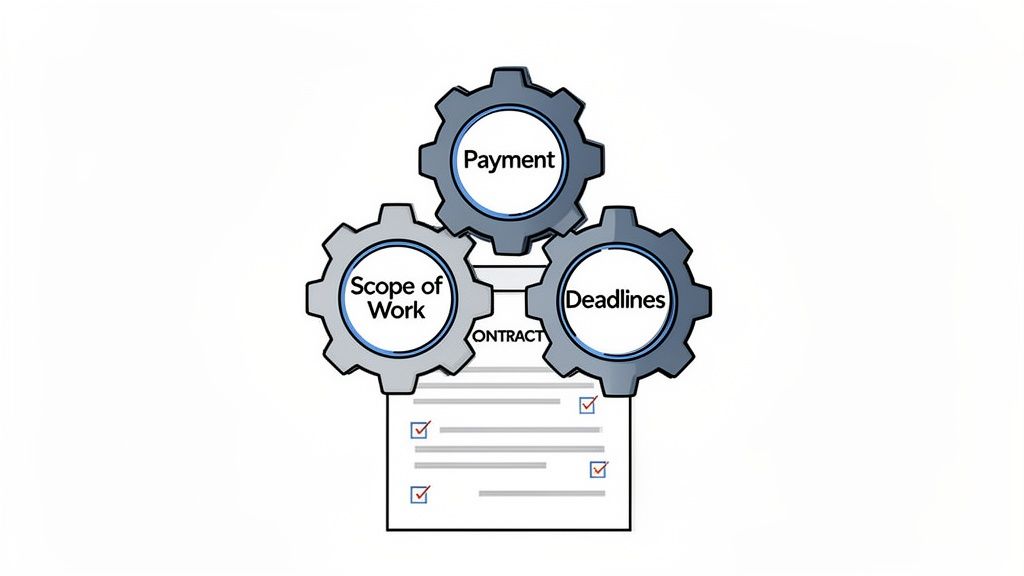

If the foundational elements set the stage, the operative clauses are the main act. These are the active, enforceable promises that form the core of your agreement—the specific duties and obligations each party has to perform. Think of them as the engine of the contract. Without them, the agreement has no power to move forward.

These are easily the most negotiated and scrutinized parts of a contract because they dictate the day-to-day reality of the business relationship. Any ambiguity here is a direct path to disputes, delays, and financial loss.

The Core Promises and Obligations

The primary operative clauses define the heart of the exchange. They answer the most critical questions: What is each party expected to do, by when, and for how much?

For a professional services firm, this section gets down to brass tacks:

- Scope of Work: A precise description of the services to be rendered, spelling out project milestones and final deliverables.

- Payment Terms: The exact amounts, the invoicing schedule, and when payments are actually due.

- Performance Deadlines: Key dates for completing milestones and the final project.

Clarity is everything here. Vague terms like “reasonable efforts” or “in a timely manner” might seem flexible, but they create huge disagreements down the line. Precision prevents misunderstandings and ensures everyone is on the same page from day one.

This level of detail is especially critical now with the rise of flexible work. Alternative employment arrangements are booming, with 11.9 million people in the U.S. alone now working as independent contractors—that’s 7.4% of total employment. These relationships rely entirely on the contract's operative clauses to define roles and deliverables, making clear terms more vital than ever. Read the full research from the U.S. Bureau of Labor Statistics about employment trends.

With BoloSign's AI contract review, you can analyze these critical clauses in seconds. The platform's intelligence flags ambiguous language, identifies potential risks, and ensures your obligations are crystal clear, giving you confidence before you send the document for an eSignature.

Defining the Contract Lifecycle

Beyond the core duties, operative clauses also govern the agreement's lifespan. The Term clause specifies how long the contract will last—whether it’s for a fixed period (like one year) or until a specific project is finished.

The Termination clause is your exit strategy. It outlines the specific conditions under which either party can legally end the agreement, such as a major breach of contract, insolvency, or even just for convenience with proper notice. A well-drafted termination clause is a vital safety net, protecting your business if the relationship sours or circumstances change.

By using contract automation tools like BoloSign, you can build templates where these critical operative clauses are standardized and pre-approved. This ensures every agreement your team creates is built on a foundation of clarity and consistency, minimizing risk from the start. You can then instantly send these robust PDFs and forms for a secure digital signing experience, setting every partnership up for success.

10. How to Manage Risk and Protect Your Business

A good contract doesn’t just map out the sunny-day scenario where everything goes perfectly. Its real power lies in planning for the rainy days. This is where risk management clauses—like warranties, indemnities, and limitations of liability—come into play. Think of them as your business’s contractual safety net.

While they might sound like dense legalese, their job is pretty straightforward: to clearly assign risk and shield your company when things don't go as planned.

Warranties: The Foundation of Trust

Let's start with a warranty. At its core, a warranty is simply a promise. When a software company provides a warranty, they're promising that their code is their own and doesn't step on anyone else's intellectual property rights. If that promise gets broken, the warranty gives you a clear path to a fix.

Indemnities: Shifting Responsibility Where It Belongs

Next up is indemnification. This is a formal commitment from one party to cover the financial losses of the other if specific problems pop up. For instance, in a logistics agreement, the shipping provider might agree to indemnify its client against any damages that happen while the goods are in their care. It’s a smart way to shift the financial risk to the party in the best position to prevent the harm in the first place.

Limitations of Liability: Capping the Downside

Finally, there’s the limitation of liability clause. This clause sets a financial ceiling on the total amount of damages one party can be on the hook for. Without this cap, a simple contract dispute could spiral into a financially devastating event. It's no surprise that this is one of the most heavily negotiated parts of any contract—it directly controls the financial exposure for everyone involved.

For a deeper dive, check out our detailed guide on limitations of liability.

To help you keep these straight, here’s a quick summary of the key risk clauses you'll encounter.

Common Risk Clauses and Their Purpose

| Clause | What It Does | Example Scenario |

|---|---|---|

| Warranty | A promise that a statement is true, like a guarantee about the product or service quality. | A vendor warrants that its software will be free from defects for 90 days. |

| Indemnity | One party agrees to cover the other's financial losses from specific third-party claims. | A marketing agency indemnifies a client against any copyright infringement claims arising from its ad campaigns. |

| Limitation of Liability | Sets a maximum financial cap on the damages a party must pay if something goes wrong. | A service provider’s liability is capped at the total fees paid by the client in the last 12 months. |

Understanding these clauses is the first step, but spotting them—and their hidden dangers—in a dense document is another challenge entirely.

Navigating these risk clauses is essential, but you don't need a law degree to do it effectively. BoloSign’s AI-powered contract review acts as an intelligent co-pilot, automatically scanning your agreements to flag risky language like overly broad indemnities or missing liability caps.

This AI contract review empowers your team to negotiate smarter and faster. A procurement manager in logistics, for example, can instantly see if a vendor's contract unfairly shifts all the risk onto their company. The AI highlights the problematic clause, allowing the manager to address it before the agreement is ever sent for an eSignature.

This level of contract intelligence is a complete game-changer. Instead of getting bogged down in slow, manual reviews, you can automate risk detection across every single agreement. With BoloSign, you can create, send, and sign PDFs online with the confidence that your business is protected.

And because BoloSign offers unlimited documents, templates, and users at one fixed price—making it up to 90% more affordable than DocuSign or PandaDoc—you can secure your business without blowing your budget.

11. Safeguarding Your Confidential Information and IP

In our modern economy, your most valuable assets are often the ones you can't physically touch. Your intellectual property (IP), trade secrets, and sensitive business data are what give you an edge. This section of a contract is your digital vault, built to protect those intangible assets. These clauses aren't just legal boilerplate; they're the shields that guard your competitive advantage.

Let's break it down. A confidentiality clause is what stops a partner or employee from sharing your "secret sauce" with the world. For a staffing agency, this is non-negotiable when dealing with sensitive client lists. Meanwhile, an IP clause draws a clear line in the sand, defining who owns that brilliant new idea, piece of code, or design created during the partnership.

Protecting Data and Ensuring Compliance

Beyond just secrets and ideas, today's contracts have to get serious about data protection. A healthcare provider, for example, needs a rock-solid data protection clause to maintain HIPAA compliance and keep patient information safe. These clauses spell out exactly how personal data is handled, stored, and secured, making sure the agreement lines up with regulations like GDPR and ESIGN.

As work arrangements get more flexible, so do the contractual needs to protect information. Look at the Netherlands, where 28% of the workforce is in flexible employment, a group that includes 1,255,000 self-employed workers and 954,000 on-call workers. Every single one of those relationships requires clear contractual safeguards to protect company data.

To get this right, you'll often need to draft a clear NDA Agreement template. This document is one of the most common ways businesses protect their confidential information from being disclosed without permission.

Executing these agreements securely is just as important as drafting them correctly. A breach during the signing process can undermine all your protective clauses. Using a secure digital signing solution is a critical part of your overall compliance and security strategy.

This is where BoloSign comes in. It provides a secure, end-to-end audit trail for every agreement, from the first draft to the final eSignature, ensuring compliance with ESIGN, eIDAS, HIPAA, and GDPR. This creates an unchangeable record, helping you prove due diligence and protect what matters most.

With its AI-powered contract intelligence, you can even identify when these crucial protective clauses are weak or missing, ensuring your IP and data are always buttoned up. You can learn more about the critical elements of a clause of confidentiality in our detailed guide.

Finalizing Your Agreement with Confidence

You’re at the finish line. The core terms are hammered out, and all that’s left is the “boilerplate” and the signatures. It's tempting to rush this part, but these final clauses are the rulebook for your relationship. Sections covering governing law, dispute resolution, and force majeure aren’t just legal fluff—they’re the essential framework for navigating disagreements if things go sideways.

Think of them as the pre-agreed instructions for what to do when a partnership hits a bump in the road. They define which state's laws apply and how you'll resolve conflicts, giving you a predictable path forward.

But the main event here is the execution—the signature. This is where a clunky, old-school manual process can become a quick, seamless digital one.

From Draft to Done in Minutes

With a tool like BoloSign, you can shrink weeks of waiting into just a few minutes of action. Forget the print-scan-mail routine. You can instantly create, send, and sign PDFs online. This isn't just about moving faster; it’s about ensuring every signature is secure and compliant. Our platform is built to meet global standards like the ESIGN Act and eIDAS, which means every eSignature is legally binding and comes with a complete audit trail.

For instance, a real estate agency can send a purchase agreement to clients across the country and get it signed and returned in under an hour, closing deals that much faster. Or a healthcare clinic can onboard a new physician by sending employment contracts and credentialing forms through a secure, HIPAA-compliant portal.

Finalizing agreements is more than just getting a signature; it’s about locking in the deal with confidence and efficiency. A streamlined execution process reflects a modern, professional operation and sets a positive tone for the entire business relationship.

BoloSign makes this professional standard accessible to everyone. We offer unlimited documents, templates, and team members for one fixed price. This makes our digital signing solutions up to 90% more affordable than alternatives like DocuSign or PandaDoc. You get to streamline your entire contract workflow without blowing your budget.

Ready to finalize your agreements with the speed and security your business deserves? Start your 7-day free trial today and see the difference for yourself.

Frequently Asked Questions

When you’re deep in the details of a contract, a few questions always seem to pop up. Here are some clear, practical answers to the most common ones we hear, designed to give you more confidence when managing your agreements.

What Are the Three Most Essential Parts of a Contract?

For any contract to actually hold up, you need three non-negotiable building blocks: the Offer (a clear, specific proposal), the Acceptance (an unconditional agreement to that exact offer), and Consideration (the value that each party gives up, like money for services).

Without these three core elements working together, you don’t really have an enforceable contract—just a conversation.

What Is the Difference Between a Clause and a Provision?

Honestly, in the real world, lawyers and business professionals use "clause" and "provision" almost interchangeably. It's a classic case of legal jargon where two words mean the same thing.

Both terms refer to a specific section, paragraph, or even a single sentence in a contract that lays out a particular rule, right, or responsibility. Think of them as the individual instructions in the rulebook for your agreement.

Can a Contract Be Valid Without a Signature?

It's a common misconception. While some simple verbal agreements can be binding, a signed, written contract is your best defense and an absolute must for most business deals. This is especially true for major agreements covered by laws known as the Statute of Frauds (think real estate deals or contracts that take over a year to complete).

A signature is the clearest proof you can have that someone read, understood, and willingly accepted the terms. It removes all doubt.

Today, using a secure eSignature platform like BoloSign is the standard for getting agreements executed properly. It does more than just capture a signature; it creates a verifiable, time-stamped audit trail that makes your agreement's validity much easier to defend and ensures you meet global standards like the ESIGN Act and eIDAS.

This digital signing solution doesn't just lock down your agreement's legal standing; it turns what used to be weeks of back-and-forth mailing into a process that takes minutes. Better yet, the platform's built-in contract intelligence and automation can help ensure every part of your contract is solid before it ever gets to the signature stage.

Ready to stop wrestling with contracts and start streamlining how you create, review, and get them signed? With BoloSign, you get unlimited documents, templates, and team members for one fixed price—often up to 90% more affordable than other tools. Start your 7-day free trial and see what smarter contract management feels like today.

Paresh Deshmukh

Co-Founder, BoloForms

5 Feb, 2026

Take a Look at Our Featured Articles

These articles will guide you on how to simplify office work, boost your efficiency, and concentrate on expanding your business.