Independent Contractor vs Employee: Your Definitive Guide

Struggling with independent contractor vs employee classification? This guide clarifies legal tests, tax duties, and risks to ensure you stay compliant.

Tired of nonsense pricing of DocuSign?

Start taking digital signatures with BoloSign and save money.

The real difference between an independent contractor and an employee boils down to one word: control. An employee works under the direct supervision of the company, while an independent contractor operates with autonomy. This choice has massive implications for taxes, benefits, legal liability, and how you manage your entire workforce.

Understanding the Core Difference Between Contractors and Employees

Deciding whether to hire a W-2 employee or engage a 1099 contractor is one of the most critical classification choices a business can make. This isn’t just a matter of preference; it’s a legal distinction with significant financial and operational consequences. Getting it wrong can lead to painful audits, back taxes, and steep penalties.

The rise of the gig economy has put this distinction under a microscope. As businesses in the US, Canada, Australia, and the UAE embrace more flexible talent models, it's crucial to get the classification right. This shift impacts every industry, from healthcare clinics using freelance medical professionals to logistics companies partnering with owner-operator drivers. The key is to get the facts straight on what defines each role.

At a Glance Comparison: Employee vs Independent Contractor

To make it simple, this table breaks down the primary factors that distinguish an employee from an independent contractor. It's organized around the three core dimensions the IRS and courts look at: behavioral control, financial control, and the nature of the relationship itself.

| Factor | Employee | Independent Contractor |

|---|---|---|

| Behavioral Control | The company dictates when, where, and how the work gets done. It often provides detailed instructions and training. | The contractor decides their own methods, schedule, and location to complete the project, focusing only on the final result. |

| Financial Control | The company handles the business side of the job, reimburses expenses, and provides the necessary tools and supplies. | The contractor invests in their own tools, covers their own business expenses, and has a real opportunity for profit or loss. |

| Relationship | The relationship is typically ongoing and indefinite. The worker is eligible for benefits like health insurance and paid time off. | The relationship is defined by a contract for a specific project or period. They do not receive employee benefits. |

The guiding principle here is economic dependence. An employee is economically dependent on the employer, whereas a true independent contractor is in business for themselves.

Understanding these differences is your first step toward building a compliant workforce. The agreement you use to formalize the relationship is your most important document. For instance, the structure of a service contract is crucial for outlining the scope of work and payment terms, which helps solidify a contractor's independent status.

Every clause in your agreement plays a role in defining this relationship, making precise and legally sound documentation non-negotiable. Whether you’re a staffing agency onboarding new talent or a real estate brokerage engaging agents, a clear, correctly executed contract protects both parties and ensures compliance from day one.

Navigating the Legal Tests for Worker Classification

Figuring out if a worker is an employee or an independent contractor isn't a gut call—it’s a decision governed by specific legal tests. Getting this right is fundamental. Misclassification can completely unravel your financial planning and expose your business to serious legal and financial risk.

While the rules vary across the globe, most frameworks boil down to one central question: who holds the right to control the work?

This single question is the foundation for almost every classification analysis, helping businesses understand exactly where the line is drawn. This flowchart breaks down how control really dictates a worker's status.

As the visual shows, if your company dictates the specifics of how, when, and where the work gets done, you're leaning heavily toward an employer-employee relationship. But if the worker retains control over their own process and methods, the relationship points toward an independent contractor.

The IRS Right to Control Test

In the United States, the most widely referenced framework is the IRS’s “Right to Control” test. This isn't a single, rigid rule but a collection of factors that agencies and courts examine to get a real sense of the working relationship. It’s broken down into three main categories.

Behavioral Control: This looks at whether your company has the right to direct and control how the worker does their job. It considers things like providing detailed instructions, specifying when to work, what tools to use, or where to perform the service. For instance, a healthcare clinic requiring a freelance nurse to follow a specific patient intake script and work fixed shifts is exerting behavioral control.

Financial Control: This category examines who controls the business side of the job. Does the worker have a significant investment in their own equipment? Are their business expenses reimbursed? A key indicator of a contractor is their ability to realize a profit or incur a loss—something not typical for an employee.

Relationship of the Parties: This focuses on how the worker and the company see their relationship. Is there a written contract describing the arrangement? Does the company provide employee-type benefits, like health insurance or paid time off? A permanent or indefinite relationship often suggests employment, while a relationship tied to a specific project points toward a contractor.

A well-drafted independent contractor agreement is your first line of defense in defining this relationship. Using a digital signing solution like BoloSign to execute these agreements ensures you have a secure, time-stamped record that clearly outlines the intended independent relationship from day one. It's an essential tool for maintaining compliance with regulations like ESIGN and eIDAS.

The Stricter ABC Test

While the IRS test offers a balanced view, some states—like California, Massachusetts, and New Jersey—use a much stricter standard known as the "ABC test." This framework presumes a worker is an employee unless the hiring business can prove all three of the following conditions:

- (A) The worker is free from the control and direction of the hiring entity in connection with the performance of the work.

- (B) The work performed is outside the usual course of the hiring entity’s business.

- (C) The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

Failing to meet just one of these criteria means the worker is legally considered an employee. This has huge implications for businesses in those states, especially for professional services firms that rely on specialized freelance talent.

A key takeaway here is that compliance isn't just about federal rules; it’s a patchwork of state and even local regulations. This complexity makes robust documentation and crystal-clear contractual terms more important than ever.

Recent regulatory shifts, such as the U.S. DOL's 2024 rule, highlight an increased focus on economic dependence as a primary factor in classification. Misclassifying a worker can lead to harsh penalties, back taxes, and lawsuits, with rules varying significantly across the U.S., EU, and APAC regions. You can explore a deeper analysis of these global workforce trends to understand the evolving landscape.

Ultimately, navigating these legal tests requires a proactive approach. By creating clear contracts and leveraging contract automation tools, you can establish compliant relationships and maintain an auditable trail, protecting your business from costly misclassification errors.

Comparing Tax and Financial Obligations

The choice between hiring an employee and engaging a contractor isn't just a matter of operations—it's a critical financial decision. Each path comes with its own set of tax and financial duties that directly shape your company's budget, administrative load, and legal exposure.

Getting these financial distinctions right is more than just a compliance checkbox. It's about building a sustainable workforce model. One wrong step can lead to some seriously painful financial penalties, including back taxes and hefty fines.

Employer Responsibilities for Employees

When you bring on a W-2 employee, you step into a significant role as a manager of their tax withholdings and a contributor to social safety nets. This route creates a predictable, but more expensive, financial structure.

Your core financial duties for an employee break down like this:

- FICA Taxes: You’re on the hook for withholding Social Security and Medicare taxes from every paycheck. More than that, you have to pay a matching employer portion. The combined rate is 15.3%, split right down the middle (7.65% each) between you and the employee.

- Unemployment Insurance: You’ll be paying both federal (FUTA) and state (SUTA) unemployment taxes. These funds are what support workers if they lose their jobs.

- Workers' Compensation: In most states, carrying workers' comp insurance isn't optional. It’s a mandated safety net that covers medical bills and lost wages for any employee injured on the job.

The real cost of an employee is often 25-30% higher than their base salary once you add up all the payroll taxes, insurance, and benefits. That's a crucial number to plug into any workforce budget model.

Contractor Obligations: A Clearer Financial Line

Working with an independent contractor, on the other hand, creates a much simpler, more direct financial relationship for your business. The burden of tax management shifts almost entirely to the contractor, who is operating as their own business entity.

The financial arrangement is pretty straightforward:

- Self-Employment Tax: Contractors are responsible for paying their own self-employment tax, which covers both Social Security and Medicare. They handle the full 15.3% themselves. Your company doesn’t withhold a dime or pay any portion of it.

- Form 1099-NEC: If you pay a contractor $600 or more during the year, your only obligation is to report those payments to the IRS and the contractor using a Form 1099-NEC. Think of it as a purely informational filing.

This model can unlock major cost savings. A real estate brokerage, for instance, avoids the constant payroll tax and benefits overhead by engaging agents as independent contractors. Similarly, a healthcare clinic can bring in a freelance specialist for a specific procedure without taking on the financial weight of a full-time hire.

The Hidden Financial Dangers of Misclassification

While the cost savings of using contractors are tempting, the financial fallout from getting the classification wrong is severe. If auditors decide you've misclassified an employee as a contractor, the penalties can be absolutely crippling. We're talking payment of back FICA taxes, unemployment insurance, interest, and substantial fines.

This is exactly why meticulous record-keeping is non-negotiable. Every independent contractor agreement, invoice, and Scope of Work is a piece of evidence proving a compliant business-to-business relationship. It's your defense.

It's also essential to recognize the comprehensive range of insurance for independent contractors that they are expected to carry on their own, such as professional and general liability. This further cements their status as a separate business entity, distinct from your own operations.

By understanding these two very different financial paths, you can build your team effectively, control costs, and keep your business out of trouble. The key is to back up every classification decision with clear, consistent, and legally sound documentation.

The High Cost of Getting It Wrong

Classifying a worker as an independent contractor when they're legally an employee is one of the most expensive mistakes a business can make. This isn't just a simple administrative slip-up; it's a major compliance failure that can unleash a torrent of financial penalties, messy legal fights, and lasting damage to your company's reputation. The fallout rarely stops with a single worker, often triggering wider government audits that put your entire workforce under a microscope.

The second a government agency like the IRS or the Department of Labor (DOL) flags a misclassification, the financial clock starts running—backward. Suddenly, you could be on the hook for years of unpaid payroll taxes, plus steep interest and fines that pile up fast.

Federal Penalties: The IRS and DOL Don't Play Around

Federal agencies take worker classification very seriously, and their penalties are designed to be a painful lesson. A misclassification finding isn't a friendly reminder; it's a demand for payment that can easily cripple a small or mid-sized business.

Here’s a snapshot of what you could be facing from the feds:

- Back Taxes: You’ll be ordered to pay all the FICA taxes (Social Security and Medicare) you should have withheld, plus the full employer-side match you failed to pay.

- Interest and Penalties: The IRS will tack on interest charges for the unpaid taxes and add failure-to-pay penalties. These fees can escalate quickly, sometimes doubling the original tax bill.

- Unemployment Tax Liability: Get ready for a bill covering back payments for federal (FUTA) and state (SUTA) unemployment insurance you never contributed to.

- Criminal Charges: In blatant cases of willful or fraudulent misclassification, the consequences can jump to another level, including massive fines and even criminal prosecution.

On top of all that, the Department of Labor can impose its own penalties, especially for violations of the Fair Labor Standards Act (FLSA), like failing to pay overtime to misclassified non-exempt workers.

State-Level Blowback and Private Lawsuits

The financial bleeding doesn't stop at the federal level. Many states have their own aggressive rules and penalties that can be even more severe. States that use the strict ABC test, like California and Massachusetts, are particularly relentless in cracking down on misclassification.

Beyond government audits, the biggest threat often comes from private lawsuits. A single contractor who believes they were misclassified can sue for back pay, unpaid overtime, and the value of employee benefits they missed out on. That one lawsuit can easily snowball into a class-action case if other workers in similar roles join in, ballooning your potential liability into the millions.

Real-World Example: A Logistics Company’s Costly Mistake: A regional logistics company classified all its delivery drivers as independent contractors to keep costs down. The problem? The drivers had to follow specific routes, wear company uniforms, and stick to rigid schedules—all classic signs of an employment relationship. A state audit uncovered the scheme, finding the company guilty of willful misclassification. The final bill was over $1.2 million in back taxes, fines, unpaid overtime, and legal fees, a hit that nearly bankrupted the business.

How Contract Automation Becomes Your First Line of Defense

This logistics company’s story drives home a critical point: proactive compliance isn't just a "best practice"—it's a survival tactic. The single most important tool for defending your classification decisions is a clear, consistent, and legally sound independent contractor agreement. This is where contract automation tools become indispensable.

Using a platform like BoloSign to create, send, and manage your contractor agreements gives you a powerful defensive advantage. Standardizing your templates ensures every agreement includes compliant language that reinforces the contractor's independent status. The platform’s AI-powered features can even help you spot risky clauses that might imply an employment relationship before they become a liability.

Even better, every action is documented. Secure digital signing solutions create an unchangeable audit trail, proving exactly when a contract was sent, viewed, and signed. This gives you concrete evidence of a formal, arm's-length business engagement. Maintaining this level of documentation is central to your defense and a key part of what is known as contract compliance. If an audit ever comes, that meticulous record-keeping is invaluable.

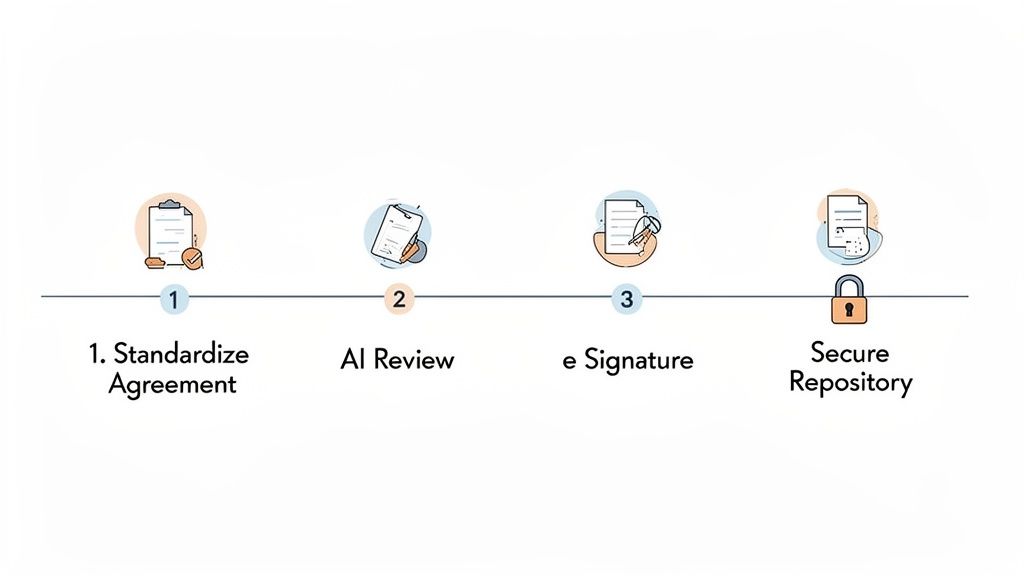

How to Build a Compliant Contractor Management Process

Avoiding the massive risks of misclassification takes more than good intentions—it demands a robust, documented, and repeatable process. Building a compliant contractor management system isn't about adding bureaucratic layers; it's about creating a clear, efficient workflow that protects your business from day one. A structured approach makes every engagement defensible and audit-ready.

This playbook breaks the process down into four essential steps. Think of it as a framework for minimizing risk while keeping things moving, so you can engage contractors with confidence, knowing your documentation backs up their independent status.

Step 1: Standardize Your Agreement Templates

Consistency is your best defense. Using a standardized Independent Contractor Agreement template ensures that every engagement starts on a compliant foundation. This isn’t about grabbing a generic file online; it’s about creating a master document tailored to your business that clearly defines the independent relationship.

Your template should explicitly state the worker is a contractor who is responsible for their own taxes, insurance, and expenses. It must outline the scope of work and deliverables, with payment terms tied to invoices—not a recurring salary. With BoloSign, you can create and store unlimited templates, making sure your entire team uses the correct, legally-vetted version every single time. This is especially useful for an education provider managing adjunct faculty contracts or a professional services firm engaging project-based consultants.

Step 2: Leverage AI for Proactive Contract Review

Before any agreement goes out the door, it's critical to ensure its language doesn’t accidentally create an employment relationship. Clauses dictating work hours, demanding exclusive service, or implying extensive training can all be red flags for auditors. Reviewing every contract for these nuances by hand is slow and full of risk.

This is where AI contract review is a game-changer. BoloSign’s AI-powered analysis can automatically scan your agreements, flagging risky clauses that suggest control or economic dependence. It helps you spot and fix problematic language before the contract is ever sent, strengthening its legal standing from the start.

A proactive review process transforms your contracting from a reactive, defensive posture into a proactive, strategic one. Catching a single problematic clause before signing can save thousands in potential legal fees and penalties down the road.

Step 3: Streamline Onboarding with Secure eSignature

The onboarding process for a contractor should feel just as professional as it does for an employee—but it must be distinctly different. Long email chains and manual paperwork create friction and can blur the lines of the business relationship. A seamless digital workflow reinforces the professional, business-to-business nature of the arrangement.

With a secure solution like BoloSign, you can sign PDFs online instantly. Send your standardized agreement to a contractor, and they can review and sign it in seconds from any device. For a staffing agency, this means onboarding dozens of contractors at once with just a few clicks. A real estate brokerage can dispatch agent agreements and get them back the same day.

Step 4: Maintain an Organized and Auditable Repository

Your compliance efforts are only as good as your records. If an audit happens, you'll need to produce signed contracts, scopes of work, and invoices fast. A scattered collection of documents buried in emails or saved on various hard drives is a recipe for disaster.

A centralized, secure repository is essential. BoloSign automatically stores every executed document, creating a complete and unalterable audit trail. You can instantly pull up any agreement, see who signed it and when, and prove you have a consistent, documented process for all contractor engagements. For industries like healthcare, this ensures HIPAA compliance and secure handling of sensitive information.

BoloSign simplifies this entire lifecycle. From creating compliant templates and using AI for review to executing contracts with secure digital signing solutions, it provides an all-in-one platform. Better yet, it does so at a fraction of the cost of competitors like DocuSign or PandaDoc, offering unlimited documents, templates, and team members for one fixed price.

Ready to build a smarter, safer contractor management process? Start your 7-day free trial to see how BoloSign’s AI-powered automation can protect your business.

A Few Common Questions About Worker Classification

Making the right call on worker classification means getting comfortable with some tricky, nuanced situations. Here are a few of the most common questions that pop up when businesses are trying to decide between an employee and an independent contractor.

Can I Engage a Contractor for a Long-Term Project?

This is a classic gray area. While there’s no official stopwatch that turns a contractor into an employee, a long-term, indefinite engagement is a massive red flag for auditors. What they really care about isn't just the duration—it's the nature of the relationship.

If a contractor starts feeling like part of the furniture, becoming deeply embedded in your day-to-day operations and taking continuous direction, you’re drifting into misclassification territory. The relationship begins to look a lot more like permanent employment than a temporary, arms-length business deal.

To stay on the right side of the line, your contracts need to be airtight. Define specific project scopes, nail down the deliverables, and set firm end dates. If you need them for recurring work, issue new, distinct contracts for each phase. This reinforces the contractor’s independent status and shows a clear project-based engagement every time.

What Clauses Must an Independent Contractor Agreement Include?

A rock-solid independent contractor agreement is your first and best line of defense. It needs to scream "business-to-business relationship" from every page, leaving absolutely no room for interpretation.

Your agreement should always include these essential clauses:

- Scope of Work (SOW): Get specific. Detail the exact services, projects, and deliverables you expect.

- Payment Terms: Make it clear that payment is tied to invoices and deliverables, not a regular salary or hourly wage.

- Tax and Insurance Responsibility: This one is non-negotiable. The contract must state that the contractor handles their own taxes, benefits, and insurance.

- Intellectual Property and Confidentiality: Define who owns the work product and ensure your sensitive information stays protected.

- Termination Clause: Outline how and when either party can walk away from the agreement.

Using a platform with AI contract review can be a huge help here. It can flag ambiguous language that might accidentally imply an employer-employee dynamic, ensuring your agreements are consistent and compliant.

A well-drafted agreement isn't just a formality; it's a legal shield. Every clause should reinforce the contractor's autonomy and business independence, leaving no doubt about the intended relationship.

How Do I Transition a Contractor to an Employee?

Moving a worker from contractor to employee status has to be a clean, formal, and well-documented break. You can't just start running payroll for them; you have to officially end one relationship before you begin the new one.

First, you need to formally terminate the existing independent contractor agreement in writing. This creates a clear legal separation between their two roles. Next, you present them with an official employment offer letter that details their new title, salary, benefits package, and their start date as a W-2 employee.

Finally, they need to complete all the standard employee onboarding paperwork, like a Form W-4 and I-9. Using a digital signing solution to manage both the contract termination and the new employment offer gives you a clean, legally binding audit trail of this critical transition.

Does Providing Equipment Automatically Create an Employee Relationship?

Not always, but it's one of the first things auditors look at. The core question is: who provides the tools and equipment essential to get the job done? When a company hands over a laptop, specialized software, or other key gear, it suggests a level of control that points straight toward an employment relationship.

Independent contractors are expected to run their own business, which generally means using their own tools. If you absolutely have to provide equipment—maybe for security reasons or system compatibility—your agreement must be meticulously clear. Frame it as a temporary loan needed for a specific project, and include strict terms for its use and return. This helps reinforce that it’s a project necessity, not a perk of employment.

Navigating the complexities of worker classification demands careful documentation and a streamlined, compliant process. BoloSign makes it simple to manage your contractor agreements with confidence. You can create, send, and sign PDFs online instantly, using AI-powered tools to ensure your contracts are compliant from the start. With unlimited documents, templates, and team members at one fixed price—up to 90% more affordable than DocuSign or PandaDoc—you can build a secure, audit-ready process without breaking the bank.

Ready to see how simple and secure contractor management can be? Start your 7-day free trial of BoloSign today.

Paresh Deshmukh

Co-Founder, BoloForms

4 Feb, 2026

Take a Look at Our Featured Articles

These articles will guide you on how to simplify office work, boost your efficiency, and concentrate on expanding your business.